Special Programs for Special Needs

Earlier this year, the Center for Disease Control (CDC) announced an alarming statistic regarding the prevalence of autism spectrum disorder (ASD), stating that is now affects 1 in 68 children (a 30% increase from 1 in 88 two years ago).

The new CDC statistics raise significant concerns about access to care, because autism is a lifelong disorder and the need for services only begins at diagnosis. According to Robert Ring of Autism Speaks, “we need a plan to respond to these numbers, a national strategy for autism, and leadership has to come from Washington, because every congressional district is affected.”

Federal and state government leaders do see the need for new programs to address the public health crisis of ASD, and have responded with urgency. Below are some examples of recent federal and state programs to help those with ASD and developmental disabilities:

- The Achieving a Better Life Experience (ABLE) Act was introduced to allow for the creation of tax-exempt savings accounts for individuals with disabilities. The funds could be used for housing, transportation, job support, medical and dental care, education, community based supports, employment training, and assistive technology — all without jeopardizing eligibility for SSI or Medicaid benefits.

- Coverage for Applied Behavior Analysis (ABA) therapy: In response to a July directive from the federal government to step up Medicaid-funded treatment for autism, a number of states are quickly moving forward to add benefits for behavioral health treatment, including ABA therapy.

- Affordable Care Act (ACA): The ACA gives more Americans access to health coverage and to no-cost preventive services, including autism screening for children at 18 and 24 months. The ACA guarantees coverage even if you or your child has a pre-existing condition, including a diagnosis of ASD, and covers a minimum set of “essential health benefits” – including behavioral health treatment, habilitative services, prescription drugs, and pediatric services.

- Health Insurance Coverage: A total of 37 states, including Virginia ( and the District of Columbia) have laws related to autism and insurance coverage, including requiring insurers to provide coverage for the treatment of autism.

- Section 1915(i) of the Social Security Act allows states to provide a combination of medical services and long-term services and supports. Services can include adult day health services, habilitation (both day and residential), and respite care.

According to the CDC report, one thing that hasn’t changed over the years is that too many children are still being diagnosed later than is optimal. The average age of diagnosis is still over age 4, even though autism can be diagnosed by age 2. The earlier a child is diagnosed with autism, the better their chances of overcoming symptoms associated with ASD. The CDC introduced, “Learn the Signs. Act Early,” to promote developmental and behavioral screening and early intervention. The Department of Health and Human Services (HHS) followed suit with the “Birth to 5: Watch Me Thrive” campaign program to help families look for and celebrate milestones; promote universal screenings; identify delays as early as possible; and improve the support available to help children succeed in school and thrive alongside their peers.

Special Needs Planning

Understandably, for many families dealing with the day-to-day struggles of caring for a child with special needs, the last thing on their minds is planning for the future. However, it is of course vitally important for parents to take the right steps to ensure their child will be financially secure and cared for in the event of death or disability of the parent, including:

- Hiring an attorney who is experienced in creating special needs trusts, such as myself;

- Clearly spelling out your wishes for the disbursement of trust funds within the trust document;

- Finding someone you can trust that has your child’s best interests at heart to serve as trustee and/or

- Hiring an institutional trustee that has a reputation for utilizing social workers and case managers to monitor the welfare of beneficiaries and determine how trust funds should be spent.

Special Needs Trust

A special needs trust is an essential tool to protect a disabled individual’s financial future. Also known as Supplemental Needs Trusts, this type of trust preserves legal eligibility for federal and state benefits by keeping assets out of the disabled person’s name while still allowing those assets to be used to benefit the person with special needs. Read more here.

When it comes to special needs planning, the Fairfax and Fredericksburg Law Firm of Evan H. Farr, P.C. can guide you through this process. If you have a loved one with special needs, call 703-691-1888 in Fairfax or 540-479-1435 in Fredericksburg to make an appointment for a no-cost consultation.

Farr Law Firm is Expanding to Help More Clients in More Areas!

We have two very special announcements to make . . . we are now handling Social Security Disability Claims and we now have an office in DC to meet with residents of the District of Columbia.

Farr Law Firm Now Handling Social Security Disability Claims and Appeals: Please Join Us in Welcoming Attorney Howard Ackerman to the Firm!

We are very pleased to announce that attorney Howard Ackerman has joined the Farr Law Firm as “Of Counsel” so that we can now offer assistance to disabled adults seeking Social Security Disability benefits. Our firm has always represented disabled individuals and their families by establishing Special Needs Trusts, handling Guardianships and Conservatorships, and other types of disability planning, but now we are also able to assist those adults seeking Social Security Disability benefits.

Mr. Ackerman has more than 27 years of legal experience. Although he is joining with our firm primarily to handle Social Security Disability claims for residents of Virginia, Maryland, and, DC, Mr. Ackerman also has his own law firm in Tyson’s Corner where he also handles the prosecution of claims for personal injury, worker’s compensation, and wrongful death.

Mr. Ackerman received his undergraduate degree from Vassar College in 1983 and his law degree from American University in 1986. Admitted to practice law in Virginia, Maryland, and Washington, D.C., Mr. Ackerman’s experience and professional achievements have earned him the highest possible ratings from his peers and from clients in the prestigious Martindale-Hubbell law directory. If you or a family member are disabled and seeking to obtain Social Security Disability Benefits, or have applied for SSD Benefits and been denied, please call our office at any time (1-800-399-FARR) to make an appointment for a complimentary consultation with Mr. Ackerman.

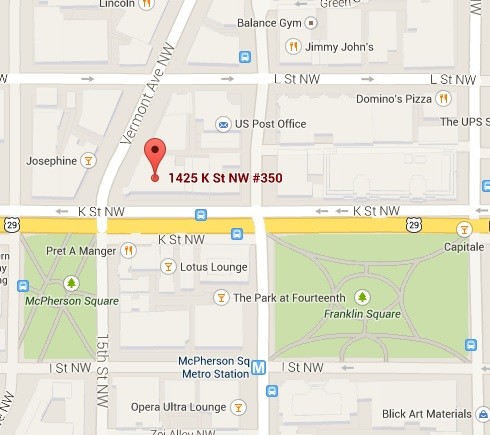

Farr Law Firm Now Has an Office in the District of Columbia

Although I have been licensed to practice law in DC since 1988 and have been serving clients in DC for over 25 years, most DC residents naturally prefer to use an attorney physically located in the District. Now, to better accommodate DC residents wishing to use our services, we are thrilled to announce our new DC location conveniently located at 1425 K Street, NW, Suite 350, Washington, DC 20005. Meetings in our DC office will be by appointment only — if you would like to schedule your no-cost initial consultation, please call us at 1-800-399-FARR.

Embracing Green Living as we Age

Q. My mother, Phyllis, is very environmentally conscious. She recycles and finds a creative use for nearly everything. Green living is among her top priorities.

Ever since my father died, my mother has had a hard time living alone. She was diagnosed with Parkinson’s seven years ago and has trouble speaking, limited mobility, and needs help with activities of daily living, including dressing and swallowing food that is not cut up.

Since I live 300 miles away, I hired a live-in caregiver to help. As much as I think the caregiver is a good fit, she doesn’t know much about green living, and I can see mom is getting frustrated about her caregiver’s “lack of concern” for the environment. Mom has trouble conveying her desires concerning the subject, since she has become really hard to understand. What are some tips I can give the caregiver to ensure mom’s concerns for green living are met? What are some options for environmentally-conscious seniors like my mother, should she need assisted living or a nursing home in the future?

A. Living a greener lifestyle is a growing trend for seniors in the United States. More than a lifestyle choice, going green has become a concern due to the health and sustainability of our planet as a whole and that of our children’s children. Senior citizens are also making green choices because they save money.

Green living is as much about conscious decision making as it is about any particular action you can take. The following are a few tips you can provide to your mother’s caregiver, so she can actively support your mother’s desires for green living:

- Proper Disposal of Medications: Most seniors take several different prescription or over-the-counter medicines to maintain adequate health. If expired or unused drugs are collecting in your medicine cabinet, do not flush them down the toilet and do not even toss them in the trash. Instead, take them to your Pharmacy for proper disposal in an “environmentally sound way.”

- Food Waste: Buy only as much perishables (e.g. fresh fruits and vegetables, bread and dairy products,) as you can reasonably eat within one week. Remember, about a third of what we throw away and truck to landfills is spoiled food and food scraps.

- Packaging Waste: Always try to buy foods and other products that come without excessive packaging. In fact, opt for those that don’t come with any! Decline plastic bags where possible and bring your own earth-friendly cloth bag when shopping. If you’re buying something that comes in plastic, check the bottom for numbers (like #1 and #2) that tell you the plastics are recyclable.

- Eliminate junk mail and flyers: You can cut down on the number of unsolicited mailings, calls, and emails you receive by learning where to go to “just say no.” The Direct Marketing Association’s (DMA) Mail Preference Service (MPS) lets you opt out of receiving unsolicited commercial mail from many national companies for five years. For more information, go to www.dmachoice.org

- Drive Smartly: Slow down on the highway to save fuel and to arrive safely. When doing errands, walk between stores rather than moving the car a few blocks. This is especially important in winter, when engines burn 50% more fuel on short trips than in summer. Remember, the average car produces between 10,000 and 12,000 pounds of climate-changing, globe-warming carbon dioxide every year.

- Conserve water: Take a bath rather than a shower or shower for less time and only with a fine spray nozzle. Don’t let the tap run while brushing teeth and fix any leaky or dripping taps.

- Electricity: Use compact florescent (CFL) options or advanced light emitting diode (LED) bulbs to dramatically reduce the amount of energy needed to generate the amount of light equivalent to an old 60 watt bulb. Making sure to turn off all lights when you leave a room or even buying new more energy-efficient appliances can all go a long way toward cleaning up your impact.

Going green doesn’t have to cost a fortune. In fact, the goal should always be to save money rather than spending it.

When it comes to senior housing, the Green House model for assisted senior living offers homes that are designed for only 10 to 12 senior residents. There are now nearly 150 Green House projects operating in 22 states.

Besides a smaller group of residents, the Green House model is different from traditional senior housing by offering residents a warm, socially interactive living arrangement, smart technology (including adaptive devices and computers) and a “green” home that lets in plenty of sunlight, and includes plants, garden areas, and outdoor access.

To learn more about the Green House model and to locate a Green House home in your area, click here. To read about green niche living, and other niche living options, please read our blog post on the subject.

Unfortunately, not everyone in all geographic areas have access to Green House living, and even for those who do, what happens when the this living model is no longer enough to meet your needs? Nursing homes in Northern Virginia cost $10,000-$14,000 a month – a catastrophic expense for most families. So regardless of whether there is a village community or other alternative senior housing option in your area, it is always prudent to plan ahead in the event that assisted living or nursing home care is needed in the future. Life Care Planning and Medicaid Asset Protection is the process of protecting your assets from having to be spent down in connection with entry into a nursing home, while also helping ensure that you or your loved one get the best possible care and maintain the highest possible quality of life, whether at home, in an assisted living facility, or in a nursing home. Learn more at The Fairfax and Fredericksburg Virginia Elder Law Firm of Evan H. Farr, P.C. website. Or call us today at 703-691-1888 for Fairfax Medicaid Planning or 540-479-1435 for Fredericksburg Medicaid Planning to make an appointment for a no-cost consultation.

Filial Responsibility: Elderly Couple May Be Responsible For Son’s Medical Bills

Peg Mohn (Picture from The Morning Call)

Filial responsibility laws obligate adult children to pay for their indigent parents’ food, clothing, shelter and medical needs. When the children fail to do so, nursing homes, hospitals, and other creditors can file lawsuits against the adult children to recover the cost of caring for the parents. Not only can they sue the children for the money, but in some states adult children can go to jail if they fail to provide filial support.

In some states, this type of legal liability may go both ways – requiring parents to pay the debts of adult children as well as the other way around. For example, Peg and Bob Mohn’s son, Earl, died at age 47, leaving behind unpaid medical bills. Now according to an article in The Morning Call, debt collectors are trying to collect the debt from his elderly parents.

In the case of the Mohns, their son Earl wasn’t married and had been ill off and on for most of his adult life. He had no assets when he died that creditors could have filed claims against. As you can imagine, the Mohns, who are in their 70s with a granddaughter who is about to go to college, did not budget to cover their adult son’s medical expenses.

Filial support laws aren’t new. In fact, they were initially derived from England’s 16th century “Poor Laws.” At one time, as many as 45 U.S. states had statutes obligating an adult child to care for his or her parents. Currently 30 states, including Virginia and Maryland, have filial responsibility laws. According to the National Center for Policy Analysis, 21 states allow a civil court action to obtain financial support or cost recovery, 12 states impose criminal penalties on children who do not support their parents, and three states allow both civil and criminal actions. Some states repealed their filial support laws after Medicaid took a greater role in providing relief to elderly patients without means. Other states, including Virginia and Maryland, did not, and a large number of filial support laws remain on the books.

Filial responsibility laws have recently been increasingly getting enforced to recover medical expenses, including Medicaid payments. For instance, in May 2012, John Pittas received a nursing-home bill of $93,000 for his mother, and was held liable. Read another example of a filial responsibility case on our blog.

Filial responsibility laws don’t always make parents and their children responsible for each other’s debts. The debtor must be indigent, and the person targeted for payment must have the ability to pay.

In the case of the Mohns and for adult children with elderly parents, the only way to make sure you do not fall victim to any filial (or parental) support action is by planning ahead. Children with elderly parents need to be proactive regarding how their parents are financing their long-term care. Some families of modest means may assume Medicaid will cover a parent’s care once the parent has depleted savings and other resources. But it’s a huge mistake to assume that Medicaid will be easy to obtain.

Medicaid laws are the most complex laws in existence, with 8 separate bodies of law (4 at the Federal level and 4 at the state level) dealing with Medicaid and Medicaid eligibility. To do proper Medicaid asset protection planning, families need the help of an experienced elder law attorney, preferably a Certified Elder Law Attorney such as myself. The best time to do Medicaid Asset Protection planning is now. Whether your parents are years away from needing nursing home care, are already in a nursing facility, or somewhere in between, the time to plan is now, not when your parents are about to run out of money. Call The Fairfax, Fredericksburg, and Washington, D.C. Elder Law Firm of Evan H. Farr, P.C. today at 703-691-1888 in Fairfax, 540-479-1435 in Fredericksburg, or 1-800-399-FARR in Washington, D.C. to make an appointment for a no-cost consultation.

Listen to Evan H. Farr, CELA being interviewed on 1500 AM (Federal News Radio) on Sunday, October 5!

Six Myths About Falls

Q. I recently visited my parents, who are in their 70’s, and have been worried ever since. My father, Sam, fell three times during the two days I was there. Often, my mother, Elaine, has lunch out and quilts with her friends, leaving dad home by himself. I questioned my mother about it and she said that falls are a normal part of aging and that she isn’t concerned. I don’t feel comfortable with this explanation. What if something happens to my father and no one is around. How common are falls in older people, and is there anything I can do to keep an eye on my father when no one is around?

A. The Centers for Disease Control (CDC) has reported that one-third of people over the age of 65 experience a fall each year, accounting for roughly 3 million visits to the ER and almost $30 billion in direct medical costs. The CDC is anticipating this number to reach an alarming $67.7 billion by 2020.

One in three residents living in a community who are over the age of 65 falls each year, and this number increases to fifty percent for people over age 80. Fall-related injuries are often serious enough to result in hospitalization and even premature death. Individuals who fall often face significant declines in mobility and independence.

Last week, on the first day of Fall, we celebrated Falls Prevention Awareness Day. This year’s theme was “Strong Today, Falls Free Tomorrow” and its purpose was to raise awareness about how to prevent fall-related injuries among older adults. As part of the initiative, the National Council on Aging (NCOA) introduced a list of myths about falls, including the one that you mentioned (that falls are a normal part of aging). Here are six of the myths and the realities to debunk them, provided by NCOA:

Myth 1: Falling happens to other people, not to me.

Reality: The truth is that one in three older adults – about 12 million – fall every year in the United States.

Myth 2: Falling is something normal that happens as you get older.

Reality: Falling is not a normal part of aging. Exercises, medication management, vision checks, and a safer living environmental are all steps you can take to prevent a fall.

Myth 3: If I limit my activity, I won’t fall.

Reality: Not necessarily true. Besides, performing physical activities helps seniors stay independent. Social activities are also good for overall health.

Myth 4: As long as I stay home, I can avoid falling.

Reality: Over half of all falls happen at home! Inspect your home for fall risks. Clear clutter and throw rugs and fix poor lighting. Make simple home modifications such as grab bars in the bathroom and nonslip paint on outdoor steps.

Myth 5: Muscle strength and flexibility can’t be regained.

Reality: People do lose muscle as they age, but exercise and Physical Therapy can help restore strength and flexibility.

Myth 6: Taking medication doesn’t increase my risk of falling.

Reality: Taking any medication may increase your risk of falling. Medications can sometimes make you dizzy or sleepy. Talk to a health care provider about potential side effects or interactions of any medications you take.

The NCOA, which is part of the National Institutes for Health (NIH), offers the free Falls and Fractures page for more tips on preventing falls. NCOA also offers a toolkit with printable materials to educate people about falls. Additionally, the Centers for Disease Control and Prevention (CDC) launched the STEADI (Stopping Elderly Accidents, Deaths Injuries) Tool Kit for Health Care Providers. In addition, the CDC is coordinating efforts and seeking financial support to launch a falls prevention campaign with the Ad Council. For more details and for CDC fall prevention resources, including older adult falls prevention guides for health care professionals, brochures, posters, podcasts, and more, visit the CDC website.

You asked how you can keep an eye on your father when no one is around. Sensor-based home monitoring systems can alert a family member or caregiver of an emergency or when something unusual has happened. For example, if a senior has not left the bathroom for an extended period of time, it could mean he or she has fallen. Personal emergency response systems, known as PERS, can also contain GPS technology. If in trouble, the wearer can press a button and be connected with a call center that can dispatch help and notify caregivers. Many PERS devices only work at home, but a few allow the wearer to get help wherever they are — on the golf course, in the car, or around the block. Read our blog post for more technology options for monitoring family members at risk of falling.

When taking preventative measures isn’t enough, assisted living or nursing home care may be needed for your loved one. Nursing homes in Washington, D.C., Fairfax, Virginia, and the rest of Northern Virginia can cost as much as $144,000 per year, while Fredericksburg, Virginia nursing homes and nursing homes in and the rest of Virginia can cost as much as $105,000 per year.

The Medicaid Asset Protection Law Firm of Evan H. Farr, P.C. handles Life Care Planning and Medicaid Asset Protection, which is the process of protecting you or your loved ones from having to go broke to pay for nursing home care, while also helping ensure that you or your loved ones get the best possible care and maintain the highest possible quality of life, whether at home, in an assisted living facility, or in a nursing home. Learn more at The Fairfax, Fredericksburg, and Washington, DCMedicaid Asset Protection Law Firm of Evan H. Farr, P.C. website. Call 703-691-1888 in Fairfax, 540-479-1435 in Fredericksburg, or 202-587-2797 in Washington, DC, to make an appointment for a no-cost initial consultation.

LGBT Marriage Ruling Brings New Planning Choices

LGBT married couples can now celebrate another important victory in their fight for equal rights. Yesterday, the Supreme Court ruled to let the appeals court rulings allowing same-sex marriage in five states stand, clearing the way for same-sex marriages in Indiana, Oklahoma, Utah, Virginia and Wisconsin. Now, same-sex couples can marry in 24 states, along with the District of Columbia, up from 19. Within weeks, the decision could expand same-sex marriage to 30 states.

Virginia’s case began in Norfolk when newlyweds Tony London and Timothy Bostic were denied a marriage license last year. Virginia’s Northampton County, which claims to have the oldest continuous court records in the entire country, including countless marriage records dating to the early 1600s, could issue its first marriage license to a same-sex couple as soon as Monday. According to Clerk of Court Traci Johnson, “I believe that love is hard to find, and if you have found it and it’s your choice, you should not miss an opportunity.” Same-sex marriage in the District of Columbia was legalized nearly five years ago — on December 18, 2009.

The recent Supreme Court ruling was preceded by a major milestone last year with the ruling in United States v. Windsor to strike down Section 3 of the federal Defense of Marriage Act (DOMA). The United States v. Windsor ruling meant that legally married same-sex couples must be treated the same as heterosexual married couples under federal laws pertaining to income and estate taxes, pensions and the like. The Windsor decision prompted several federal agencies to revise their policies to entitle married same-sex couples to federal benefits and tax advantages.

What Benefits Do Same-Sex Married Couples Qualify for Now?

Social Security Benefits

Married couples get a big financial boost from certain Social Security benefit programs that have not historically applied to LGBT couples.

Spousal survivor benefit: A surviving spouse of a worker entitled to Social Security retirement or disability benefits may be entitled to receive retirement benefits based on the deceased spouse’s earning record.

Spousal retirement benefit: For retired married couples, a person whose calculated Social Security benefit is lower than that of his or her spouse may take half of his or her spouse’s higher benefit, rather than receive the amount calculated from his or her own earnings.

Lump-sum death benefit: A surviving spouse gets $255 from the federal government to help pay for funeral arrangements.

Estate Tax and Estate Planning Benefits

Estate and gift tax exemption: Federal law exempts a certain amount of money from federal estate taxes and federal gift taxes for all property left to a surviving spouse (currently the exemption is $5,340,000). The surviving spouse does not pay taxes on any amount he or she receives from the deceased spouse that’s under the exemption limit.

Estate Tax “Portability:” Married couples can combine their personal estate tax exemptions. This means that the second spouse to die can leave property worth up to $10,680,000 free from federal estate tax. Unmarried couples do not get the “portability,” so that the second partner in a relationship to die can leave only $5,340,000 tax-free.

Veteran and Military Benefits

Spouses of deceased veterans are entitled to numerous benefits, including health care, death pensions, educational assistance, home loan guarantees, vocational training, and bereavement counseling.

Spouses of living military personnel may be eligible for health care, family separation pay, and relocation assistance, among many other benefits. Same-sex married spouses should also be entitled to these services and benefits.

Tax Benefits

Filing joint income tax returns with the IRS: Filing a joint return may offer advantages over separate returns. Many unmarried couples lose thousands of dollars per year because they have to file separate tax returns with the IRS.

Federal Employee Benefits

Last summer, the Office of Personnel Management announced that federal employees in LGBT marriages could apply for health, dental, long-term care, life and retirement benefits.

Medicare

The Department of Health and Human Services said that legally married LGBT seniors on Medicare would be eligible for equal benefits and joint placement in nursing homes.

Immigration

The Department of Homeland Security will treat LGBT spouses equally for the purposes of obtaining a green card if the spouse is a foreign national. And the IRS has begun treating same-sex marriages equally for tax-filing purposes.

While laws are changing to promote greater equality for LGBT seniors, whether you are gay or straight, if you haven’t done so, now is the time to get started with planning for your future and for your loved ones! We here at the Fairfax, Fredericksburg and Washington, DC LGBT Law Firm of Evan H. Farr, P.C. have strategies in place to help LGBT couples, whether married or not. With advance planning, each person, regardless of sexual orientation, can retain the benefit of the money, income and assets it has taken a lifetime to accumulate. Please call us at 703-691-1888 in Fairfax, 540-479-1435 in Fredericksburg, or 202-587-2797 in Washington, DC, to make an appointment for a no-cost consultation.