Posted by admin on October 12, 2017 · Leave a Comment

Posted on October 11, 2017 ·

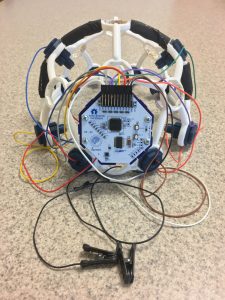

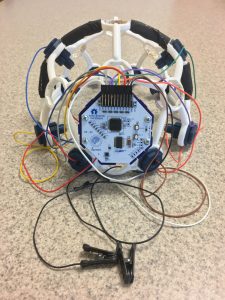

University of Maryland Student Invention- EEG to diagnose Alzheimer’s (photo: NIH)

Alzheimer’s disease is an irreversible, progressive brain disorder that slowly destroys memory and thinking skills and, eventually, the ability to carry out the simplest tasks. It is the most common cause of dementia in older adults.

Currently, doctors can’t definitively diagnose Alzheimer’s, so they typically inform patients of “possible Alzheimer’s dementia,” “probable Alzheimer’s dementia,” or some other problem causing memory complaints. The only definitive diagnosis that exists for Alzheimer’s comes from an autopsy. However, a team of sophomores at the University of Maryland, College Park, may have invented a gadget that could help change that! In fact, they just won first prize in a National Institutes of Health (NIH) competition for their prototype portable EEG device designed to diagnose Alzheimer’s, in a convenient, inexpensive manner.

“The solution is really smart and has the potential to really work,” said Zeynep Erim, program director at NIH’s National Institute of Biomedical Imaging and Bioengineering and a judge in the contest. She was impressed by the students’ entry in the Design by Biomedical Undergraduate Teams (DEBUT) Challenge.

From Concussions to Alzheimer’s

When the students were working on their entry for the competition, they were initially focusing on concussions, since there has been a lot of discussion of concussions in professional football players. The students were thinking of how they could use an electroencephalogram (EEG), a test that records the electrical activity of the brain, to diagnose brain waves for concussion.

When their initial idea didn’t work out, they shifted their focus to whether an EEG could be used to diagnose Alzheimer’s. They discovered a lot of literature on the topic, but nothing was ever brought to market. Both of the student team leaders had relatives who had died of Alzheimer’s, so the students thought this could be a way their research could help other individuals and families afflicted by the disease.

How the Invention Works

The EEG used in a research lab typically has as many as 256 electrodes, is the size of a desk, and costs hundreds of thousands of dollars. The team felt that it was much more than it needed for its purposes, as it only takes eight or 16 electrodes to record brain waves.

Therefore, they used a portable EEG with an open source headset, the Ultracortex by OpenBCI, which costs less than $2,000, and connected it to a laptop computer. Using this, the team would look at the brain signals and finds patterns in healthy patients and those with Alzheimer’s. They then extracted features from brain signals and asked the computer what kinds of patterns it saw.

The small-scale trial the students did was with existing data from other studies. The machine, using data from the portable EEG and mathematical algorithms created by the students, was able to predict Alzheimer’s in those patients with 83% accuracy. “It’s definitely not diagnostic yet, but I think it gives it some value,” said Christopher Look, one of the student researchers.

NIH calls the device “a noninvasive and relatively inexpensive tool with the potential to detect Alzheimer’s disease with a high level of accuracy.” The agency says the device “could make dementia diagnosis more quantitative, systematic and less costly — allowing doctors to use it at regular checkups.”

Next Steps for the Students

Currently, the student researchers are figuring out if they want to pursue research for early diagnosis or for diagnosis of current patients. Either would be an improvement from what is used today. The most widely used diagnostic tools now are a questionnaire, the Mini-Mental State Exam (MMSE), and an MRI and PET scan, which are expensive and disruptive. “If this [test] can tell you there’s something wrong or you just need further testing, it [the device] could still be valuable to a patient,” Look said.

Another possible way to test for Alzheimer’s

An experimental blood test is another test that is being developed to possibly diagnose Alzheimer’s disease, according to a study published in the journal, Proceedings of the National Academy of Sciences. Though still in development, the test may someday be used to diagnose other degenerative brain disorders and even mild cognitive impairment resulting from head injuries.

The researchers say that using the test, they were able to identify Alzheimer’s patients with up to 86% sensitivity and specificity. The test also differentiated Alzheimer’s from dementia with Lewy bodies, a related condition, with 90% sensitivity and specificity.

The test is currently beyond pilot studies, and in the validation phase. It could take 5-10 more years, however, before it’s fully released. Researchers are still concerned that at this time, the accuracy isn’t high enough, and could lead to misdiagnoses. Read more about this blood test on CNN’s website.

Benefits of Early Diagnosis

Hopefully, the EEG developed by the students and the blood test become viable ways to accurately test for Alzheimer’s in the future. Once people with Alzheimer’s find out that they have the disease, they can take advantage of the benefits to early diagnosis, even though no treatment or cure currently exists. For instance, those who learn that they are likely to have Alzheimer’s could enroll in clinical trials testing possible treatments. Another potential benefit could be that it will help those with Alzheimer’s work with their family, caregivers, and an experienced elder law attorney, such as myself, to plan for their future and their loved ones.

Medicaid Planning for Alzheimer’s and Other Types of Dementia

Alzheimer’s is the biggest health and social care challenge of our generation, and a diagnosis of the disease is life-changing. When it comes to planning for long-term care needs, generally, the earlier someone with dementia plans, the better. But it is never too late to begin the process of Long-term Care Planning, also called Lifecare Planning and Medicaid Asset Protection Planning.

Medicaid planning can be initiated by an adult child acting as agent under a properly-drafted Power of Attorney, even if your loved one is already in a nursing home or receiving other long-term care.

Medicaid Asset Protection

Do you have a loved one who is suffering from Alzheimer’s or any other type of dementia? Persons with dementia and their families face special legal and financial needs. Here at the Farr Law Firm, we are dedicated to easing the financial and emotional burden on those suffering from dementia and their loved ones. We help protect the family’s hard-earned assets while maintaining your loved one’s comfort, dignity, and quality of life by ensuring eligibility for critical government benefits such as Medicaid and Veterans Aid and Attendance. As always, please feel free to call us for a no-cost initial consultation:

Fairfax Alzheimer’s Planning: 703-691-1888

Fredericksburg Alzheimer’s Planning: 540-479-1435

Rockville Alzheimer’s Planning: 301-519-8041

DC Alzheimer’s Planning: 202-587-2797

Go to Source

Posted by admin on October 7, 2017 · Leave a Comment

Q. Our daughter, Melanie, recently came to visit us. She told us that she and her husband will be meeting with your firm to do their estate planning and incapacity planning. Then, she inquired about what we put in our estate plan. We were taken aback by the question, and luckily, the time wasn’t ideal to have a conversation with our grandchildren jumping on our laps.

I know it will come up again. My wife and I discussed it and first and foremost, we want to consider the relationships between our daughter and her sisters. So, although we were hesitant at first, we decided it’s a good idea to have this conversation all of them. What we don’t know is how we should tell them. Should we meet with each daughter separately to focus on just one important and unique person at a time? Or is it better to gather them all in one place so everybody hears the exact same message in the same words? What things should we make sure they are aware of? Thanks for your help!

A. For those of us who have completed our estate planning and incapacity planning, the most stressful part of the process is often the prospect of telling family members what you plan to do with your assets, and what your wishes are. In many instances, parents shy away from discussing these things with their grown children, because they are afraid that children will strongly disagree with choices that are made, be angry or disappointed, will build too much on their expectations for an inheritance, or will be resentful of other heirs. As difficult as it seems, you are making a good choice to have this conversation with your adult children.

So, what’s the best way to tell your grown children about your plans, without creating family drama? That depends on your situation. For instance, do any of your daughters have special circumstances, such as difficulty handling money or a physical, mental, or emotional challenge? If so, the conversation will look different than if all your daughters will inherit equally. In most situations, however, a balanced approach to sharing information about family wealth is the best option.

Setting Up the Family Estate Planning Meeting

The purpose of your meeting will be to tell your adult children what they can expect and what roles they may play in the future managing the estate.

Before the talk, determine the goals and objectives you want to achieve and draft an outline or an agenda, with a few talking points. Choose a quiet place for the meeting that will make everyone feel comfortable and secure.

During the meeting, speak in a calming tone and use words such as “safety,” “security” and “protection.”

If the environment gets toxic, don’t lash out or shut down out of fear, anger, embarrassment, defensiveness or any other unpleasant feeling. Make sure everyone has an opportunity to speak. Should thorny issues arise, try to come up with solutions. It can be helpful to have a trusted adviser at this family meeting, to help ensure an atmosphere of tolerance, patience and impartiality.

Things to tell your children

The following is information that you should share with your children at this meeting, so they know that your estate is in order and can ensure that your plans will be carried out accordingly:

1. Who’s on your team: If you work with financial and legal professionals, compile a list of their names, addresses and phone numbers (or let them know where to find that list if they need it). Include names and numbers of your doctors, in case medical decisions need to be made.

2. Who the executor will be and where the documents are: Tell them how recently your documents were written, who will be the executor, and where they are. If your documents are more than five years old, be sure to review them with us to make sure your current wishes are represented.

3. What are the details and who will be the agent(s) for the Advance Medical Directive and Financial Power of Attorney: Disclose your feelings about life support and other end-of-life issues, and disclose who will manage your financial affairs if you no longer can.

4. Who your beneficiaries are: Tell them who the beneficiaries on insurance policies, pensions, and investments are and how to locate the paperwork. Make sure your designations are up-to-date to reflect your current wishes.

5. What financial accounts you have — and where: Put together a list of your bank, brokerage, and mutual fund accounts and your account numbers. If you have any user names and passwords on the accounts, include those also. Put the list in a safe place, such as a safety deposit box, and make sure they know how to access it when it is needed.

6. What insurance you have and where the policies are: If you or your wife become incapacitated, your children will need to know about your health insurance — private or Medicare. Also, provide info about your life insurance, auto, homeowners, disability and long-term-care policies, so they know your coverage and whom to contact to cancel.

7. Where your financial paperwork is: You’ll want to tell them where to find the title to your house and car, your property deed, and all loan documents.

8. Where your tax files are: Let them know where they can find your previous years’ returns.

9. How you envision your memorial service: This information is in your estate planning documents, but it doesn’t hurt to discuss what kind of funeral you have in mind, assuming you want one, and where you want to be buried or cremated. Tell them about any burial plots you have that they might not know about.

10. Whether you’re an organ donor: This is also in your incapacity planning documents (part of your estate planning), but again it is good to tell them your preferences in advance and let them know where you keep your organ-donor designation (on a driver’s license or if there’s an organ donor card.)

11. Where your safe-deposit box and key are located: The executor of your estate may be able to get into the box without a key, but it’ll probably involve a drill and a substantial fee. Save them the headache and let them know in advance where they can find the key!

12. Where other important passwords are located: Set up Keepass or Lastpass and keep all your passwords in one place. Share how they can access this file, when needed.

I hope your family meeting goes smoothly. If your family is experiencing conflict regarding your estate planning wishes, please read our article, “How to Minimize Family Conflict Over Your Estate Planning Wishes,” for tips on how to handle it.

Planning in Advance is Important!

If any of the members of your family have not done their estate planning or incapacity planning, or not had it reviewed and updated in the last five years, please contact us as soon as possible to make an appointment for a no-cost consultation:

Fairfax Estate Planning: 703-691-1888

Fredericksburg Estate Planning: 540-479-1435

Rockville Estate Planning: 301-519-8041

DC Estate Planning: 202-587-2797

Go to Source

Posted by admin on October 7, 2017 · Leave a Comment

Dear Ribbit,

I understand that discussing estate planning with adult children can be an emotionally charged conversation. However, I know it’s a critical topic to address with family members. In my situation, my daughter is very sensitive and has always thought my wife and I favor her brother. It’s not true. We honestly don’t favor one child over the other. We do, however, want to leave him certain things, such as my classic car, because he is a car enthusiast. To be fair, my wife will be leaving her diamond jewelry to our daughter. How can we make what will likely be a difficult conversation less emotional?

Thanks!

Les Emoshuns

—-

Dear Les,

Mr. Farr suggests that people “talk early and talk often” about their estate plans.

Inevitably, emotion will be part of the conversation, but if you let it get out of control it can quickly derail the conversation, especially in a time of crisis where emotions are charged. This is why you should discuss your estate planning when you are healthy and when the family is already together, like during birthdays and holidays. When you normalize the conversation you’ll find that this emotional topic is much more manageable.

Also, plan for several meetings, not just one. Expecting to start the conversation and have a resolution all in one meeting is not realistic. Instead, plan to have a few conversations at different times, until you get the details sorted out. The goal is to talk early and often, and when you do you’ll find emotions are less likely to derail these important conversations.

Hop this is helpful!

Ribbit

Go to Source

Posted by admin on October 5, 2017 · Leave a Comment

Rudy North was an avid reader, who had a sharp mind and liked to write down quotes from his favorite books. Rennie, his wife of fifty-seven years, was recovering from lymphoma and suffered from neuropathy so severe that her legs felt lifeless. Yet, she spent her mornings prettying herself up for her husband, who referred to her as his “amour.” She was still of sound mind, and enjoyed the conversations she had with her husband and her nurse.

Rennie was happy living in her home on the outskirts of Las Vegas with her husband Rudy, a retired consultant for broadcasters. Rennie had the help she needed, with a nurse that visited five times a week to help her bathe and dress.

Retirement was going well for the Norths, until one summer day in August of 2013, when April Parks, a so-called “professional guardian” allegedly kidnapped Rudy and Rennie. They had no idea what was happening. Their only daughter, Julie Lynn Belshe, knew nothing about this. Julie says she was in daily contact with her parents and visited often, along with her husband and children. Julie says she was never contact by lawyers or by the court; never went to court; did not receive any phone calls from any lawyers or the court; and there were no letters or court documents sent to their home.

April Parks, who allegedly identified herself as an officer of the court, showed up at the North’s home with an entourage of other people. According to Julie’s parents, Ms. Parks and the others told them, “We have an emergency order to remove you from your home. You have three choices; we can call the police and you will go to jail; you can come to Lakeview Terrace (assisted living facility) in Boulder City and stay there; or you can be placed in a psychiatric ward.” Rennie started crying and told them to leave her home; Rudy, who was very worried about his wife, said they would go to Lakeview. April Parks told Rennie, “Don’t worry, you are only going there to rest for three weeks.” They were then put in a car and taken away.

The house they were living in was emptied of all of their personal belongings, allegedly stolen by the guardian. Many items were also discarded, which their daughter found in trash bins. The money in their bank accounts was allegedly stolen by April Parks, along with their identity; licenses, credit cards, and social security cards. Court hearings were held and, according to Julie, “all court documents were fabricated with a host of lies, including the story that she was an addict.” Julie spoke up in court but said that the judge ignored everything she said. According to information given to Julie by other sources, the judge and guardian already had a large number of complaints filed against them.

Parks continued to control every aspect of Rudy and Rennie’s lives — where they would live, how their money was spent, what items they could keep –and sometimes, who they could see. She charged their estate exorbitant amounts for simple tasks, such as opening mail.

In 2015, the North’s nightmare was over. The court found that Parks failed to protect the Norths and, especially, their estate. When referring to April Parks, Guardianship Commissioner Jon Norheim said, “She’s supposed to block the money. She’s supposed to come to court for release. That didn’t happen. It got spent. Things got sold. None of that was supposed to happen!”

Norheim took private, for-profit guardian April Parks off the case of Rudy and Rennie North. Guardianship was given instead to their daughter, Julie Belshe, who’s been fighting to get her parents out of the system for nearly two years. This disturbing situation hopefully paved the way for others in a similar situation to escape, since sadly, the Norths were not the only ones affected by this nightmare.

The example at the core of this story is very disturbing but also, thankfully, very unusual. It would appear that Nevada may have very unusual guardianship laws. And it is important to note that different laws govern different jurisdictions, and that there are many where the laws are humane and direct the guardian to give the ward maximum self-determination and provide counsel or a court-appointed independent investigator for the proposed ward, impose court supervision over the guardian as well a criminal background checks, among many other protections for wards and potential wards.

You can read more about this case in this recent New Yorker article.

What is Guardianship and How Could This Have Happened?

Guardianship is a legal relationship in which the court authorizes one person with the power to make personal and/or financial decisions for another person. The person authorized with decision-making power is known as the guardian and the person for whom the decisions are being made is known as the ward. Guardianship over the person typically goes along with Conservatorship over property, which in some states is called Guardianship over Property.

Guardianship and Conservatorship is assigned when a person has been determined by a judge to lack the capacity to make rational and intelligent decisions in regard to his or her own medical decisions and/or finances. Usually it is a family member who applies for Guardianship and Conservatorship, but it can also be a friend, or in some cases the County or City in which the ward resides. In some cases, as was the case with the Norths, a third party may be appointed as Guardian and/or Conservator, particularly if no one close to the ward is deemed appropriate. Conservators are subject to the nightmare of “living probate,” meaning that, among other things, they must file annual accountings every year with the Probate Court or Commissioner of Accounts.

A Power of Attorney is a legal document created by one person, known as the principal, to give another person, known as the agent, legal power to act on behalf of the principal. The document can grant either broad and unlimited powers or limited powers to act in specific circumstances or over specific types of decisions. Typically a Power of Attorney is effective immediately, but is intended to be used only when necessary at some future date.

In most cases, Power of Attorney is greatly preferred to Guardianship because:

• The principal retains more control over who makes the decisions and what decisions they can make;

• Power of Attorney has significantly lower costs compared to applying for guardianship;

• No court is involved when creating or using a Power of Attorney;

• No annual accountings are required to be filed when using a Power of Attorney;

• More privacy is maintained with a Power of Attorney (probate court proceedings are public record);

• The principal may revoke the Power of Attorney at any time so long as the principal has the mental capacity to do so, whereas a Guardianship and Conservatorship can only be revoked by the court.

A Power of Attorney would have been a preferable option for the Norths, to avoid the nightmare they went through, since they were both competent and of sound mind.

Do You Have a Power of Attorney?

A properly-drafted Financial Power of Attorney is the most important legal documents that a person can have, and is an essential part of every Incapacity Plan and Estate Plan. It authorizes an agent, sometimes called “Attorney-in-Fact,” to act on your behalf and sign your name to financial and/or legal documents.

If you have not done Incapacity Planning or Estate Planning, or if you have a loved one who is nearing the need for long-term care or already receiving long-term care, the time to plan is now.

In addition, if you have not updated your planning documents in a while, don’t let too much time pass between reviews of your plan. The cost of a review is minimal; but the cost to your family if you neglect your plan could be disastrous. Be sure to ask about The Farr Law Firm’s Lifetime Protection Program, which ensures that your documents are properly reviewed and updated as needed, so that they will have the proper effect under the law.

Please contact us as soon as possible to make an appointment for a no-cost consultation:

Fairfax Power of Attorney: 703-691-1888

Fredericksburg Power of Attorney: 540-479-1435

Rockville Power of Attorney: 301-519-8041

DC Power of Attorney: 202-587-2797

Go to Source

Posted by admin on October 5, 2017 · Leave a Comment

By Fredrick P. Niemann, Esq. of Hanlon Niemann & Wright, a Freehold, NJ Power of Attorney Lawyer

Clients often ask me to prepare a Power of Attorney. Often they have two or more children and ask if they should name both (or none) of them as attorney-in-fact. Most of the time the clients assume then children will jointly agree to make all decisions about everything together. But that’s when the clients thinking seems to stop.

A dual agent power of attorney can and generally requires each agent to agree in order to act. The easier (and I think better) approach is to allow each to act independently of the other. This approach has advantages and disadvantages. The one risk with the “either/or” approach is that one sibling acts and unintentionally (or intentionally) fails to notify the other. If a parent doesn’t quite trust one or both of the children, making them co-agents who must agree creates a checks-and-balances system that might give them peace of mind.

On the negative side, requiring them to agree might damage their relationship if they cannot see eye-to-eye. It could also be cumbersome if a quick decision is needed and one of them is not available for consultation. Another potential disadvantage: Many banks will reject a power of attorney that requires both co-agents to sign checks. With so many transactions done online and telephonically, banks find it difficult to determine if both agents are truly in agreement. You may be better off allowing each child to act independently, or name one as the primary agent and the other as the successor agent.

Seriously evaluate each child’s personality and capabilities, as well as how your plan could impact their relationship. Then discuss the issue candidly with them and with your estate planning/elder law attorney.

To discuss your NJ Power of Attorney matter, please contact Fredrick P. Niemann, Esq. toll-free at (855) 376-5291 or email him at fniemann@hnlawfirm.com. Please ask us about our video conferencing consultations if you are unable to come to our office.

Go to Source

« Previous Page